Understanding Unisocks : How unisocks works?

Imagine selling a pair of socks at a price of USD 90k, well, that is quite astonishing. but this is happening in the crypto world. Back in 2019 Uniswap, launched an exchange, where the users can trade SOCKS ERC20 tokens and redeem them for the real pair of socks. Instead of keeping the price fixed, they are using exciting mathematical formulas and components like the bonding curve.

Imagine selling a pair of socks at a price of USD 90k, well, that is quite astonishing. but this is happening in the crypto world. Back in 2019 Uniswap, launched an exchange, where the users can trade SOCKS ERC20 tokens and redeem them for the real pair of socks. Instead of keeping the price fixed, they are using exciting mathematical formulas and components like the bonding curve.

What is a bounding Curve?

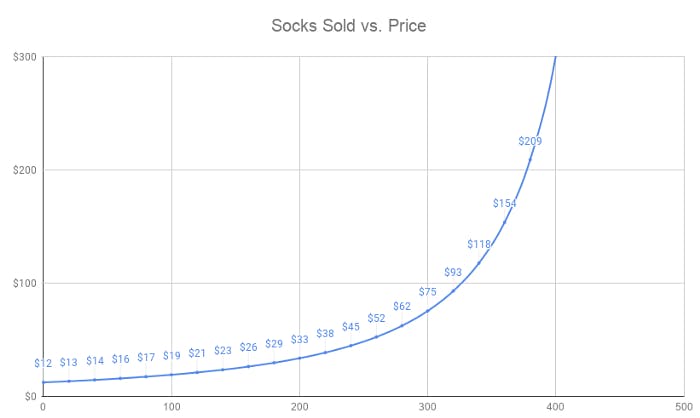

A bonding curve shows the relationship between the supply and price of the asset. the most basic example is bitcoin. Bitcoin has a limited supply, so whenever any new user purchases the bitcoin, it needs to pay slightly more. this is because supply decreases constantly and Price Increases.

Unisocks is using a similar concept, where they have minted only 500 SOCKS tokens, and every pair of socks represents one sock token. During the launch of uni socks, the price was around 55 USD but after two years it has reached almost USD 90k.

How did this work?

If you know about Decentralised Exchanges, you must have heard about the Pools, these pools are nothing but consist of liquidity of two tokens. you can build a pool of Any token A and token B. Unisocks used a similar pool concept in which they built a Pool of 35 Ethereum Paired with the 500 SOCKS token. Any user who is interested to purchase SOCKS tokens from the eth can use that pool.

All the Pools made using Uniswap use the special formula called X*Y = k where X is the number of tokens in Reserve A and Y is the number of tokens in reserve B. This formula helps to decide the price. So every time any purchase is made, the price is calculated based on this formula by a smart contract.

For example, imagine there is a pool of token A which has 100 tokens in a reserve, and token B which has 10 tokens in reserve. The initial price would be 10 tokens A per token B. Imagine A seller A comes and buys the 10 Tokens A for 1 Token B, the supply at the Pool is now 90 Tokens A and 20 tokens B. so now the price is token A is 0.22 token B whereas earlier it was around 0.1 token B. so this is how the price exponentially increases when more and more tokens are purchased.